Expert Insights: What You Required to Know About Credit Repair Solutions

Expert Insights: What You Required to Know About Credit Repair Solutions

Blog Article

How Credit Scores Repair Work Functions to Eliminate Errors and Boost Your Creditworthiness

Credit history repair service is a vital procedure for people seeking to enhance their creditworthiness by attending to mistakes that may compromise their monetary standing. By meticulously examining credit report records for typical mistakes-- such as wrong individual details or misreported repayment histories-- people can launch a structured dispute process with credit bureaus.

Recognizing Credit News

Debt reports serve as a monetary snapshot of an individual's credit report, describing their borrowing and repayment actions. These reports are compiled by credit report bureaus and include critical info such as credit history accounts, arrearages, payment background, and public records like bankruptcies or liens. Economic institutions use this information to examine an individual's credit reliability when getting financings, charge card, or home mortgages.

A credit rating report commonly includes individual details, including the person's name, address, and Social Safety and security number, in addition to a list of charge account, their condition, and any kind of late payments. The report additionally outlines credit score questions-- instances where loan providers have actually accessed the record for evaluation functions. Each of these parts plays an essential role in figuring out a credit history, which is a mathematical representation of credit reliability.

Understanding credit score records is crucial for consumers aiming to manage their monetary health and wellness successfully. By routinely evaluating their reports, individuals can make sure that their credit rating history properly reflects their financial behavior, hence placing themselves positively in future loaning undertakings. Recognition of the contents of one's credit history record is the initial step towards successful credit scores repair and overall financial health.

Usual Credit Rating Report Mistakes

Mistakes within credit score reports can significantly impact an individual's credit history and overall monetary health. Usual credit report errors consist of inaccurate personal information, such as wrong addresses or misspelled names. These discrepancies can bring about complication and may affect the evaluation of creditworthiness.

An additional frequent error includes accounts that do not belong to the person, typically resulting from identification burglary or imprecise information access by lenders. Blended documents, where someone's credit scores information is integrated with an additional's, can additionally occur, specifically with people that share comparable names.

Additionally, late repayments may be inaccurately reported because of refining errors or misconceptions regarding repayment days. Accounts that have been cleared up or paid off might still look like outstanding, additional complicating an individual's credit history profile.

In addition, inaccuracies relating to credit limits and account balances can misstate a customer's credit use proportion, a crucial consider debt scoring. Acknowledging these errors is necessary, as they can lead to higher rate of interest, lending denials, and enhanced problem in obtaining credit scores. Routinely evaluating one's credit record is a positive procedure to identify and remedy these usual errors, therefore guarding monetary wellness.

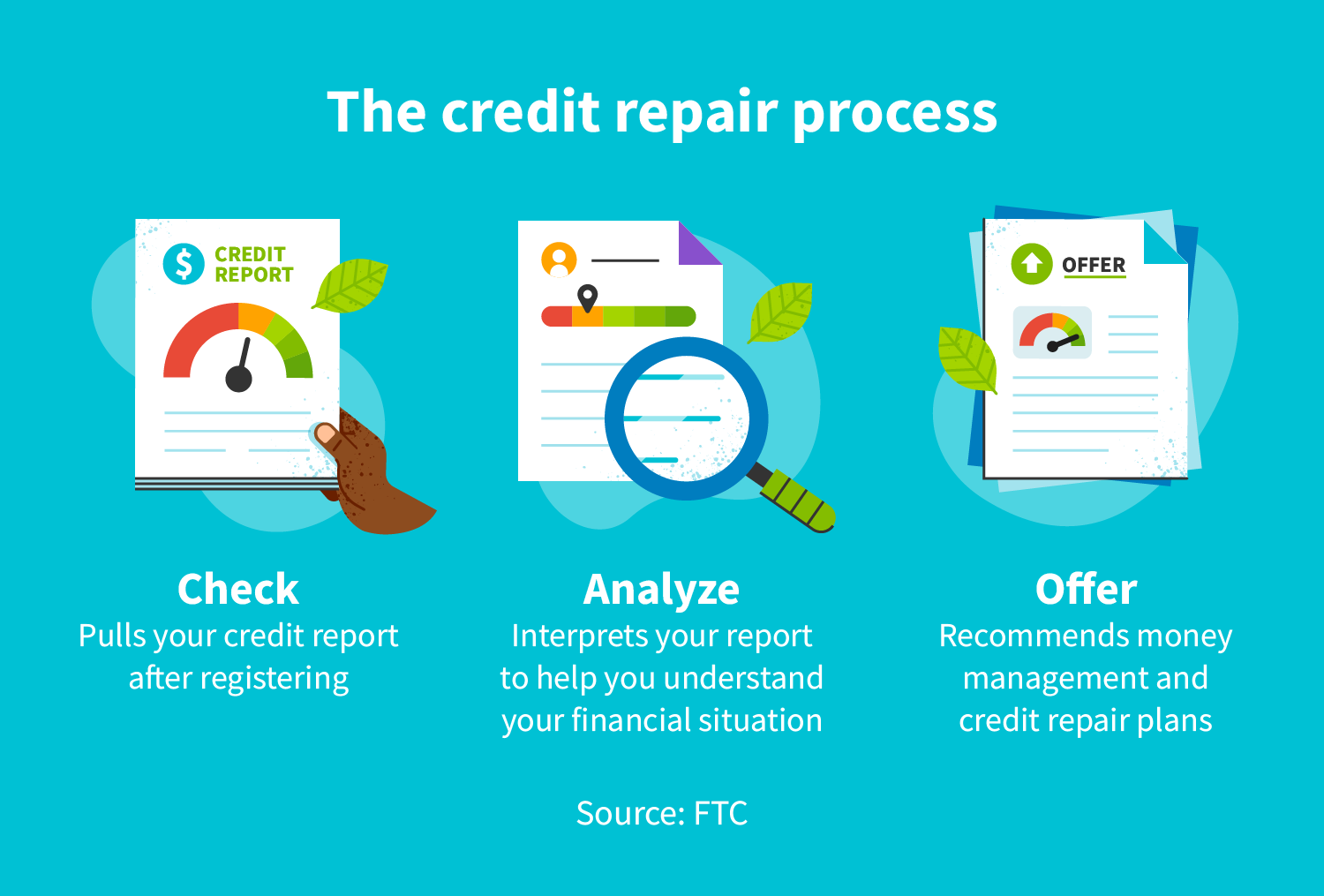

The Debt Fixing Refine

Browsing the debt repair work procedure can be a complicated job for lots of individuals seeking to enhance their financial standing. The trip begins with getting a comprehensive credit record from all three major credit bureaus: Equifax, Experian, and TransUnion. Credit Repair. This permits customers to identify and comprehend the variables impacting their credit rating scores

When the credit reference history report is assessed, people need to classify the information right into accurate, imprecise, and unverifiable products. Exact details ought to be maintained, while inaccuracies can be opposed. It is important to collect supporting documents to substantiate any type of claims of error.

Following, individuals can pick to either handle the procedure individually or enlist the aid of professional debt repair work solutions. Credit Repair. Experts usually have the competence and resources to browse the complexities of debt reporting regulations and can streamline the process

Throughout the debt repair work process, keeping prompt repayments on existing accounts is critical. This demonstrates responsible monetary habits and can favorably affect credit history scores. Ultimately, the credit score fixing procedure is a systematic technique to determining issues, contesting inaccuracies, and cultivating much healthier monetary behaviors, leading to enhanced credit reliability in time.

Disputing Inaccuracies Properly

An efficient conflict process is essential for those aiming to fix inaccuracies on their credit scores records. The very first action entails obtaining a duplicate of your credit rating report from the significant credit score bureaus-- Equifax, Experian, and TransUnion. Evaluation the record meticulously for any discrepancies, such as incorrect account details, obsoleted info, or deceptive entries.

Next, start the disagreement process by speaking to the credit report bureau that released the record. When sending your disagreement, provide a clear description of the error, along with the supporting proof.

Benefits of Credit Rating Fixing

A plethora of benefits goes along with the process of credit score repair work, substantially influencing both financial stability and total lifestyle. Among the main Get More Information advantages is the possibility for better credit rating. As errors and errors are remedied, individuals can experience a remarkable rise in their credit reliability, which straight affects lending approval rates and passion terms.

In addition, debt repair work can boost accessibility to beneficial funding alternatives. Individuals with greater credit rating are more probable to get reduced rates of interest on home mortgages, auto finances, and personal car loans, eventually leading to substantial savings over time. This improved economic flexibility can help with major life decisions, such as purchasing a home or investing in education.

With a clearer understanding of their credit history circumstance, individuals can make informed selections concerning credit scores usage and monitoring. Credit report fixing usually includes education on economic literacy, empowering individuals to adopt much better costs practices and preserve their credit history health and wellness lasting.

Final Thought

In conclusion, debt repair service serves as an essential device for boosting credit reliability by dealing with mistakes within credit history reports. The organized identification and disagreement of mistakes can lead to significant enhancements in credit rating, therefore assisting in accessibility to better funding choices. By comprehending the nuances of credit scores records and utilizing effective conflict approaches, individuals can accomplish better financial health website here and wellness and security. Eventually, the credit history fixing process plays a vital role in promoting informed economic decision-making and long-term financial wellness.

By meticulously examining debt reports for usual mistakes-- such as inaccurate individual information or misreported repayment histories-- people can start a structured conflict process with debt bureaus.Credit scores records serve as a financial picture of a person's credit rating history, detailing their loaning and repayment actions. Awareness of the contents of one's credit record is the very first action towards effective debt repair work and general economic wellness.

Errors within credit scores reports can significantly affect a person's debt score and total monetary wellness.Additionally, inaccuracies regarding credit limitations and account equilibriums can misrepresent a customer's debt use proportion, a vital factor in credit history racking up.

Report this page